Your credit scores is more than just a number — it’s a reflection of your financial reliability. Whether you’re applying for a mortgage, a car loan, or even a mobile phone contract, lenders use this score to determine how likely you are to repay borrowed money. Understanding what affects your credit score can help you build a stronger financial foundation and unlock better borrowing opportunities.

What Is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness. In the UK, credit reference agencies such as Experian, Equifax, and TransUnion calculate these scores using data from your credit history. While scoring models differ slightly, scores generally range from 0 to 999, with higher numbers indicating better credit health.

Typical categories include:

-

Excellent: 800–999

-

Good: 700–799

-

Fair: 600–699

-

Poor: Below 600

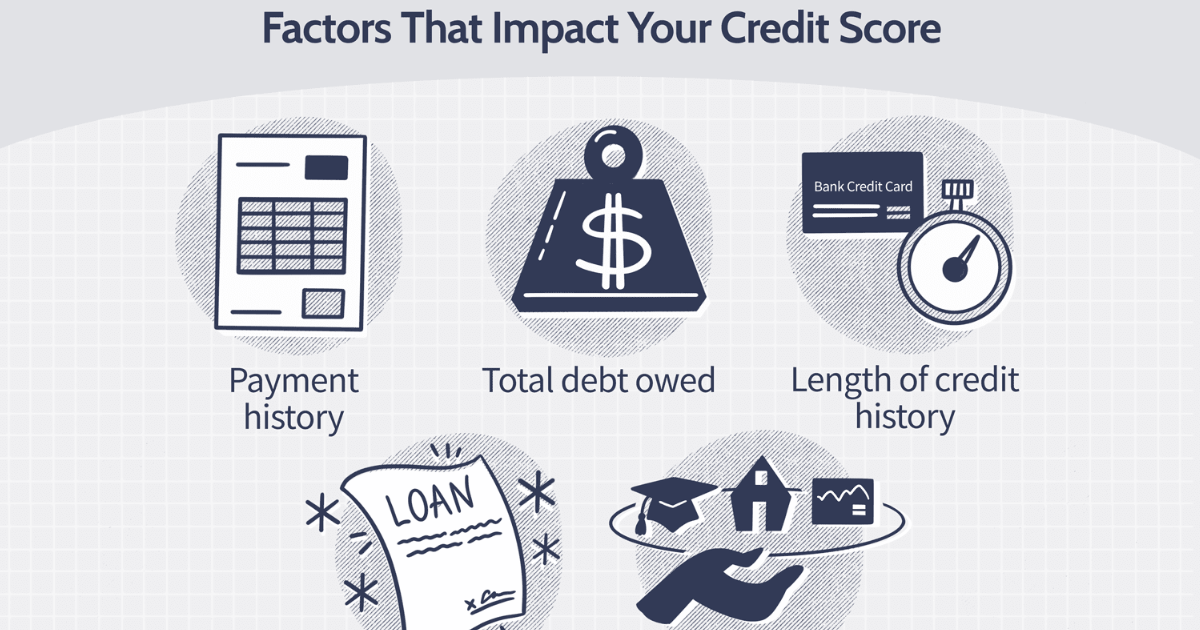

Key Factors That Influence Your Credit Score

-

Payment History (35%)

This is the single most important factor. Lenders want to see that you consistently pay your bills on time. Missed or late payments on loans, credit cards, or utility bills can significantly reduce your score and remain on your record for up to six years. Setting up direct debits or reminders can help ensure timely payments. -

Credit Utilisation (30%)

Credit utilisation measures how much of your available credit you’re using. Ideally, you should use no more than 30% of your total credit limit. For example, if your card limit is £2,000, keeping your balance under £600 shows you’re managing credit responsibly. High utilisation signals financial stress to lenders and can lower your score. -

Length of Credit History (15%)

The longer your accounts have been open, the better. A long credit history helps lenders assess your spending and repayment habits over time. If you’re new to credit, consider keeping older accounts open and active rather than frequently closing and opening new ones. -

Credit Mix (10%)

A balanced mix of credit types — such as credit cards, personal loans, and car finance — demonstrates that you can manage different financial responsibilities. However, opening multiple credit accounts in a short time can make you appear overextended. -

New Credit Applications (10%)

Every time you apply for credit, lenders perform a hard inquiry on your file. Too many hard checks in a short period can lower your score and signal financial instability. To protect your score, only apply for credit when necessary and use eligibility checkers that perform soft searches instead.

Additional Factors to Consider

-

Errors on Your Credit Report: Even small mistakes — such as an incorrect address or a wrongly recorded missed payment — can harm your score. It’s wise to check your credit report regularly with agencies like Experian or ClearScore to dispute any inaccuracies.

-

Financial Associations: If you share a joint account or loan with someone, their financial behaviour can affect your score. Avoid linking finances with someone who has poor credit.

-

Public Records: County Court Judgments (CCJs), bankruptcies, or Individual Voluntary Arrangements (IVAs) have a major negative impact on your credit file and remain visible for several years.

How to Improve Your Credit Score

-

Pay bills on time every month.

-

Keep credit utilisation low (ideally under 30%).

-

Avoid multiple credit applications within short periods.

-

Check and correct errors in your credit report.

-

Stay registered on the electoral roll, as it verifies your identity for lenders.

Why Your Credit Score Matters

A high credit score gives you access to better loan terms, lower interest rates, and higher credit limits. It can also make renting property easier, as many landlords check your financial reliability. On the other hand, a poor credit score can limit your options and increase the cost of borrowing.

Final Thoughts

Understanding the factors that shape your credit score is the first step toward improving it. With consistent financial discipline — making timely payments, keeping debt low, and monitoring your credit report — you can build a solid score that opens doors to financial opportunities and long-term stability.